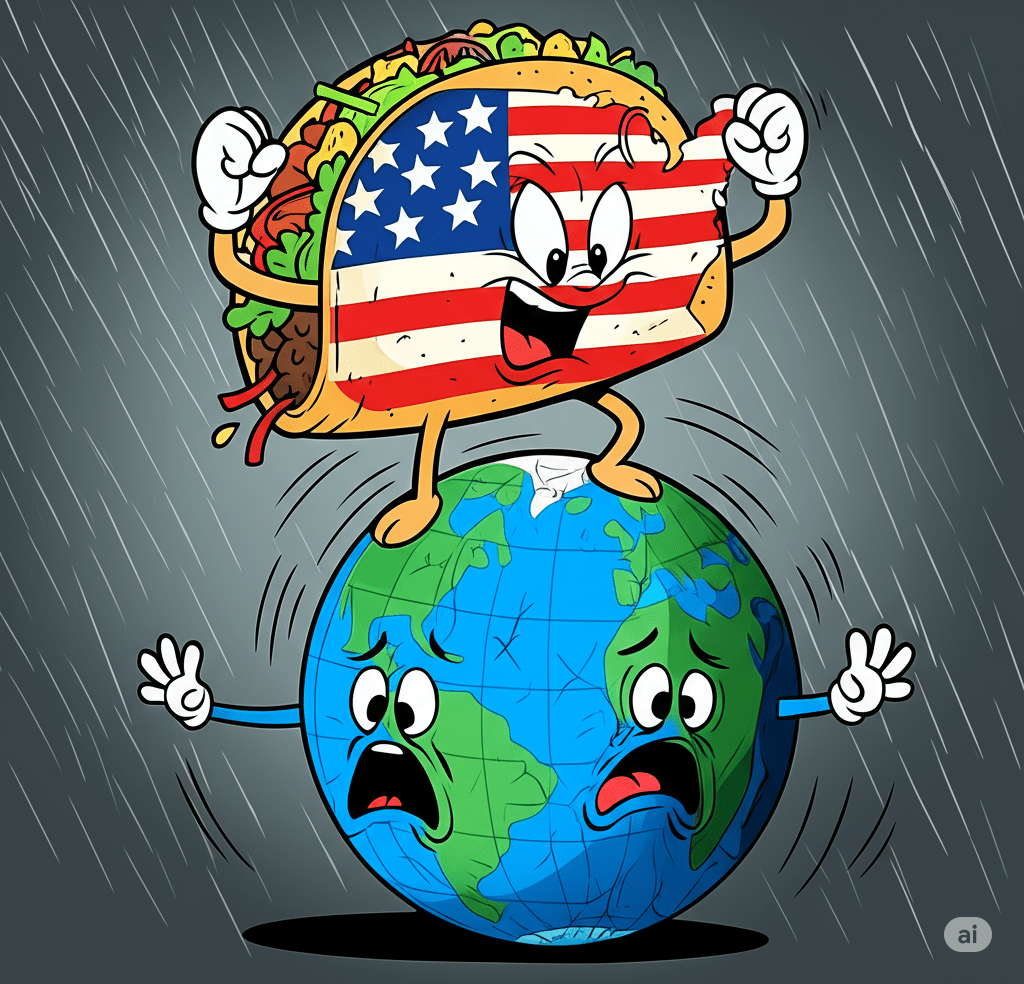

In fact, you’d be hard pressed to find a trade model built for the job. Models designed to simulate what happens when tariffs (and other trade impediments) are removed are not calibrated to measure the imposition of tariffs. Anyone claiming tariff liberalisation and imposition have the same magnitude impacts lacks a fundamental understanding of how trade works.

Moreover, if the tariffs form part of an unprecedent period of economic policy uncertainty, then trade is the least consequential problem. Trade is a flow, whereas investment and financial wealth have both stocks and flows. Damage to capital stocks are an order of magnitude more economically damaging than trade could ever be. Especially if uncertainty means investors don’t know where to invest and safe assets like US Treasuries start looking like bitcoin.

And trade will continue no matter the tariff rates and their volatility. The impact on short-term trade volumes and prices is of far less consequence than the erosion of international trade rules and governance. An unwinding of this system risks a damaging and difficult to reverse rise in informal trade.

These thoughts are addressed in greater depth across two articles:

Malaysia can weather the Donald Trump tariff storm

Repeated Shocks Risk Trade Exiting The System